Consolidated Orders and Delivery for Groceries and Everyday Market

My Role:

Contract UI Design | Product Design | User Research | Testing.

Tools:

Figma | Miro | Adobe Illustrator | Adobe Photoshop.

My role was Senior UI/Product Designer within the Everyday Market Tribe working on the Woolworths website alongside the Tribes Lead UX designer Anastasia Attia. Focusing on improving order transparency and checkout.

Conducting discovery, ideating early concepts, running sprint reviews, presenting design huddles regularly to leadership, and delivering final assets for production. I worked with multiple cross-functional teams, including product managers, engineers, and leads from Content, Legal, Comms, and Product Ops.

Context Summary

The implementation of three major phases connected across the products ecosystem:

1. Everyday Market Multi-shipment and Shipment Fulfilment (Q3 - Q4 2021)

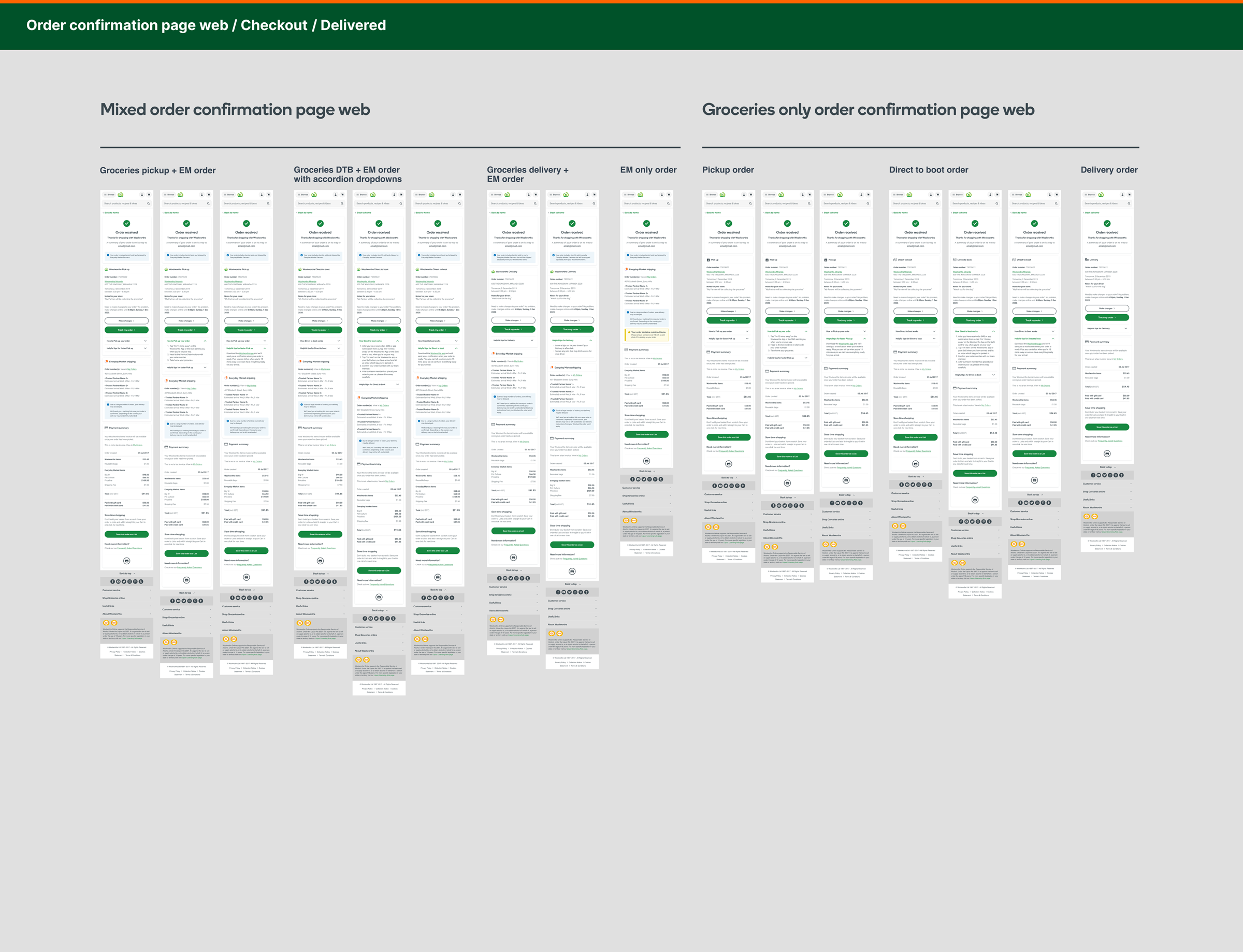

2. Woolworths Grocery and Everyday Market Mixed Order Confirmation (Q4 2021 - Q1 2022)

3. Woolworths Grocery and Everyday Market Order Tracking (Q1 - Q2 2022)

Currently, there is a disconnect between Woolworths Grocery and Everyday Market items, with customers having no education about the two Woolworths operations. The customers see them as one brand and delivery, with a lack of transparency as to why mixed orders arrive at different times. Woolworth's items are groceries and are available for pickup/direct-to-boot or direct delivery by the Woolworths Group. Everyday Market items are partner business dependent and are shipped directly from the partner business by couriers. They are not available for pickup or delivery by Woolworth's drivers.

Problem Statement

Focusing on mixed basket delivery and pick-up for customers shopping within both Woolworths groceries and Everyday Market items, not knowing the difference between Woolworths groceries and Everyday Market.

Woolworth's items when delivered come from only three fulfilment centres nationwide; Sydney, Melbourne and Brisbane. However, it is always estimated, depending on location to reach the customer within two days.

Everyday Market items are estimated to reach the customer within ten business days. This lack of delivery transparency as well as the lack of education around Multi-shipment Orders is a challenge for the business and sees customers drop off during checkout.

Are mixed basket pick-up customers removing Everyday Market items from their baskets and continuing their grocery purchases or are they dropping out of their session altogether?

We don't capture the selected fulfilment prior to checkout. This means in reality the difference is definitely even starker, but we can see the big drop-offs after adding to the cart and in checkout.

We believe we’re seeing a higher drop-off rate in the pickup journey because these customers want to save on delivery costs and hence why they will go to their nearest store instead of picking up their groceries. So when they find out there's a shipping cost for Everyday Market items, we’re assuming they remove the items for that reason.

Customer Verbatim’s

“Didn't realize I was ordering from a different company and then I got another shipping fee. If I decide to order from Woolworths I expect it to come from Woolworths.”

“If I'm honest I was anticipating the delivery coming within a day or two or even with shopping and it didn't. So I had to go out and buy it elsewhere, as I needed it.“

"I have no idea why they were not delivered with the rest of the order. I have had them delivered several times with my online orders"

“I was disappointed with my whole online order.....I didn't know it would be coming from Big W as we shopped from Woolworths and if I had known this I would have chosen a different dog food brand to be delivered with the order”

“Product was available in store but instead of just putting the product in my order it was shipped by the market partner and took more than a week to arrive.”

The Business Problem

Are mixed basket pick-up customers removing Everyday Market items from their basket and continuing their grocery purchase or are they dropping out of their session altogether?

Are mixed basket pickup customers switching devices from the web to the app and completing the flow in the app where we don’t support mixed pickup baskets?

Time on task - at what point in the journey are users spending the most time on?

Are customers adding to their basket and then coming back another day to complete the flow?

A Woolworths customer who has made a single-seller, multi-item purchase from Everyday Market (eg. 3x items from Big W).

Unbeknownst to them, their order is being fulfilled from several different locations and at different times.Customers trying to understand the status of the items in their order and when they will arrive. However, they can only see a single order status within the experience and only receive a single set of notifications. Because Everyday Market doesn’t have the experience in place to support split fulfilment today.

Customers are clicking on the ‘Where’s my Order?’ call-to-actions which calls CHUB at the cost to the business. As well as a need to increase the VOC (Voice of the customer) Delivery Satisfaction.

Online NON-App:

Let's reduce these numbers!Order to the Checkout Process:

Drop-off rate - 60%

(Pickup and Delivery combined)The Checkout Process:

Drop-off rate - 77%

(Pickup and Delivery combined)Delivery Method:

Cart to Checkout Delivery only- 61%Delivery Method:

Cart to Checkout Pick Up only- 39%

User Goals

We believe that keeping the user in focus will achieve a frictionless experience and we will know we are successful when the user has completed their journey with an immersive satisfaction and understanding of what they have completed and what they expect will happen next to be true. Creating a simple fulfilment experience will allow customers to worry less about when and how their shopping will arrive.

We believe that simplifying the options of how customers select and how to get their order, will create an easier experience for customers when they finalise the order. For the customer, this will give time back and for the business make it less likely for the customer to abandon the cart.

Business Goals and Opportunity

Large retailers such as Big W often send e-commerce orders from multiple locations including both warehouses and stores depending on where the item is ranged and the stock is available.

Harness the power of the Woolworths logistics network to provide Everyday Market customers with a reliable, trustworthy and truly unrivalled marketplace delivery experience.

Everyday Market and National Products Fulfilment have been allocated space in 3x Customer Fulfilment Centres (CFCs) to unlock new delivery capabilities.

Customer education around the Everyday Market brand awareness, personalisation of the product, journey and to become frictionless, so it doesn't even feel like work to the user.

There are further opportunities around UI utility call-to-actins, order-tracking micro-interactions, and process bars. Allowing cart and checkout to become an immersive user experience.

Design Principles

The challenges and obstacles around information hierarchy, consistency, user control and changes to the business UI library pattern were and still are ongoing. Hard rules around call-to-actions were just one example of design constraints. As well as colour hierarchies and legal requirements.

From a technical feasibility perspective, only certain date points within the backend were unachievable and determined how our solution from an architectural perspective could work as well. This is still an ongoing process that WooliesX is chipping away at successfully and is ongoing.

Solution and New Experience

Customers who pick up groceries are more price sensitive than their delivery brethren and thus are put off by the Everyday Market delivery fee at checkout and remove these items from their cart.

Some of our information panels/error messages may be too strongly worded and are potentially confusing or scaring users away.

In order to effectively communicate the status of split orders, we need to splice it into sub-orders and provide an experience and logic layer which can treat each item separately.

Evolve more effectively communicating the order status for split orders, we’ll improve Customer Satisfaction Score (CSAT) and lower the volume of contacts to the customer hub concerning estimated arrival times and the prevalence of the “Where’s my item?” disposition code.

Design Process Double Diamond

Discovery

1. Problem | 2. Data | 3. Heuristic evaluation | 4. Competitive analysis | 5. Voice of the Customer (VOC)

Define

1. Synthesise insights | 2. Feature priority | 3. Requirements

List of features - we prioritised what features were the most impacted and started T-shirt sizing these tasks. This was sometimes done leading up to Big Rock Prioritisation (BRP) for the slated project that had its discovery done before its allocated quarter. We often had discovery slated into the last half of a quarter and before the projects allocated quarter.

Develop

1. Explore concepts and design | 2. UXR testing | 3. Iterations | 4. Collect feedback | 5. Rinse & Repeat

Two rounds of testing all PASSED

1. Everyday Market Multi-shipment and Shipment Fulfilment

2. Mixed Order Confirmation

3. Order Tracking

Deliver

1. Hi-fidelity UXR testing | 2. Iterations | 3. Collect feedback | 4. Rinse & Repeat | 5. Dev handover

Two rounds of testing all PASSED

1. Everyday Market Multi-shipment and Shipment Fulfilment

2. Mixed Order Confirmation

3. Order Tracking

Conclusions and Learnings

At its simplest, customers will have visibility over their orders and the status of each item. This will decrease post-purchase consternation and dissuade customers from contacting Customer Hub to get an update which will save the business money.

We will reduce the drop-off rate in the pickup journey because these customers want to save on delivery costs and hence why they can go to their nearest store instead to pick up their groceries. So when they find out there’s a shipping cost for Everyday Market items, we’re assuming they remove them for that reason. We can’t necessarily solve this by reducing the drop-off rate because these customers are trying to save but what we can do is help them build their basket to meet the free shipping threshold.

New Lists and Content cards with Itemised topical, category or timely listings for separating Everyday Market and Woolies products. Allowing for greater scannability, customer immersiveness and empathy around Everyday Market brand awareness and transparency of deliveries. This will help in breaking down further user friction in Order Reviews, Delivery, and Checkout.